The price of a strike of a stock is $40/share. The price of a one-year European stock with price of $30 quoted as $7/share put option on the on the shorts with

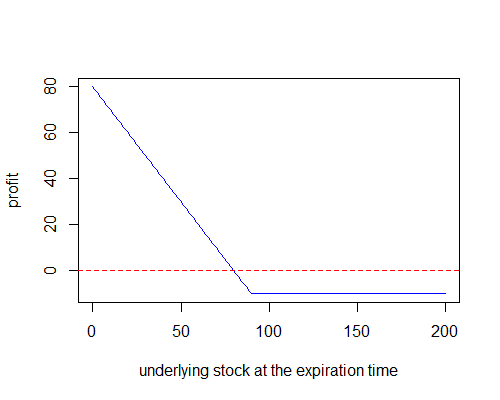

Problem 9.9 Suppose that a European call option to buy a share for $100.00 costs $5.00 and is held until maturity. Under what ci

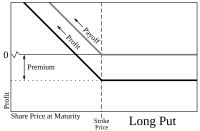

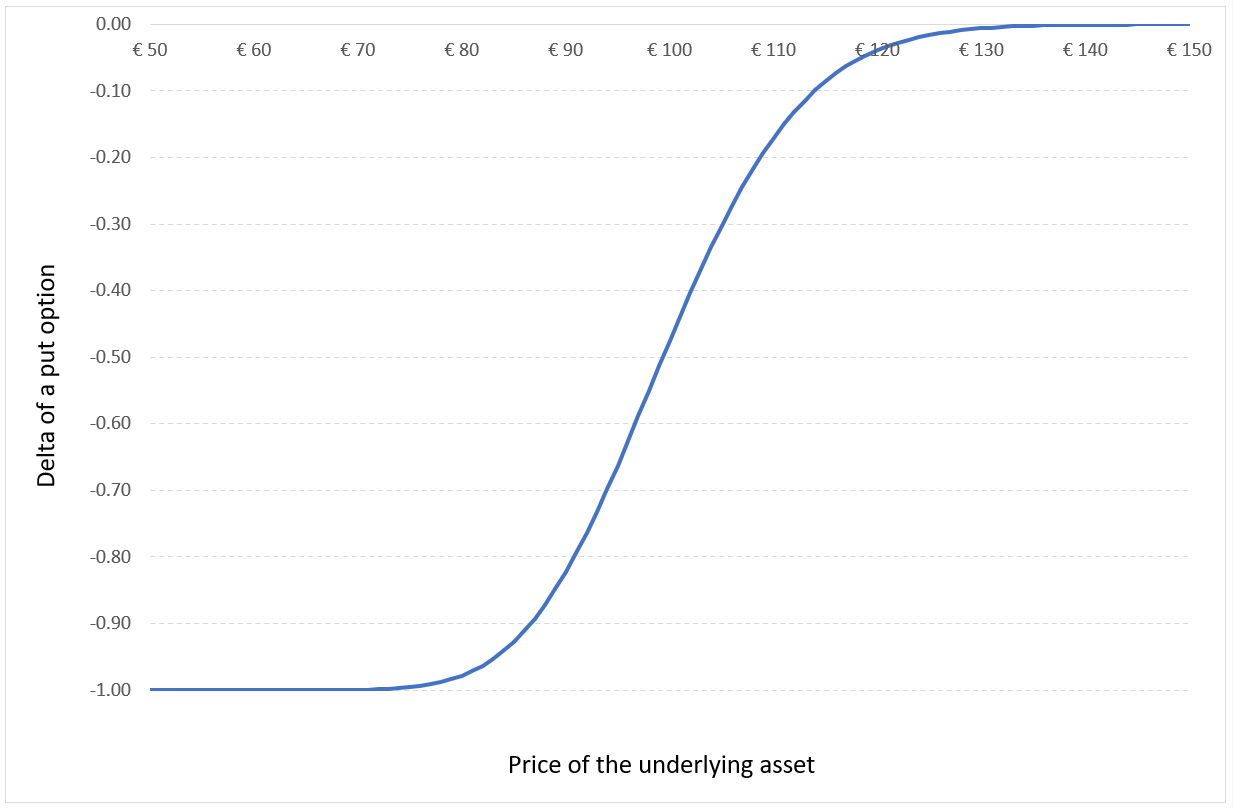

The price of a stock is $40. The price of a one-year European put option on the stock with a strike price of $30 is quoted as $7 and the price of

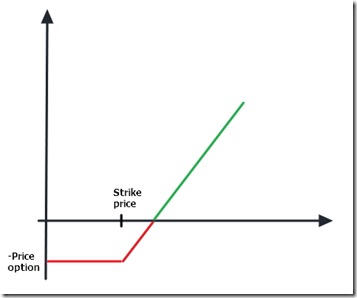

2: Payoffs for a European call option (left) and put option (right)... | Download Scientific Diagram

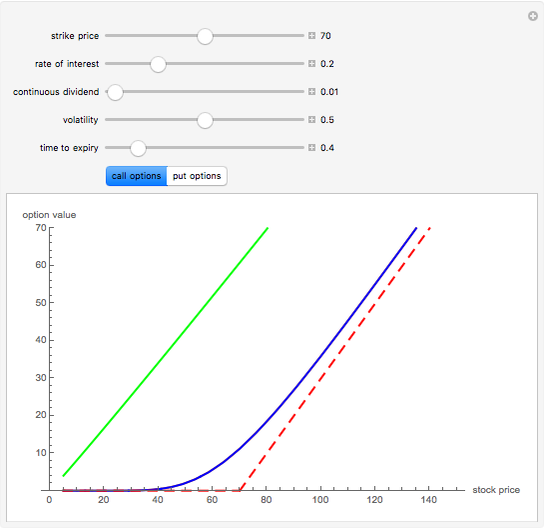

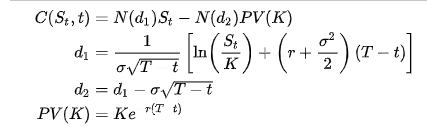

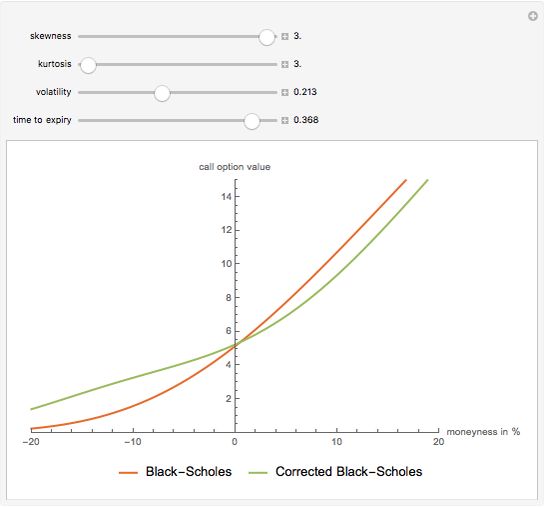

The Black-Scholes European Call Option Formula Corrected Using the Gram-Charlier Expansion - Wolfram Demonstrations Project